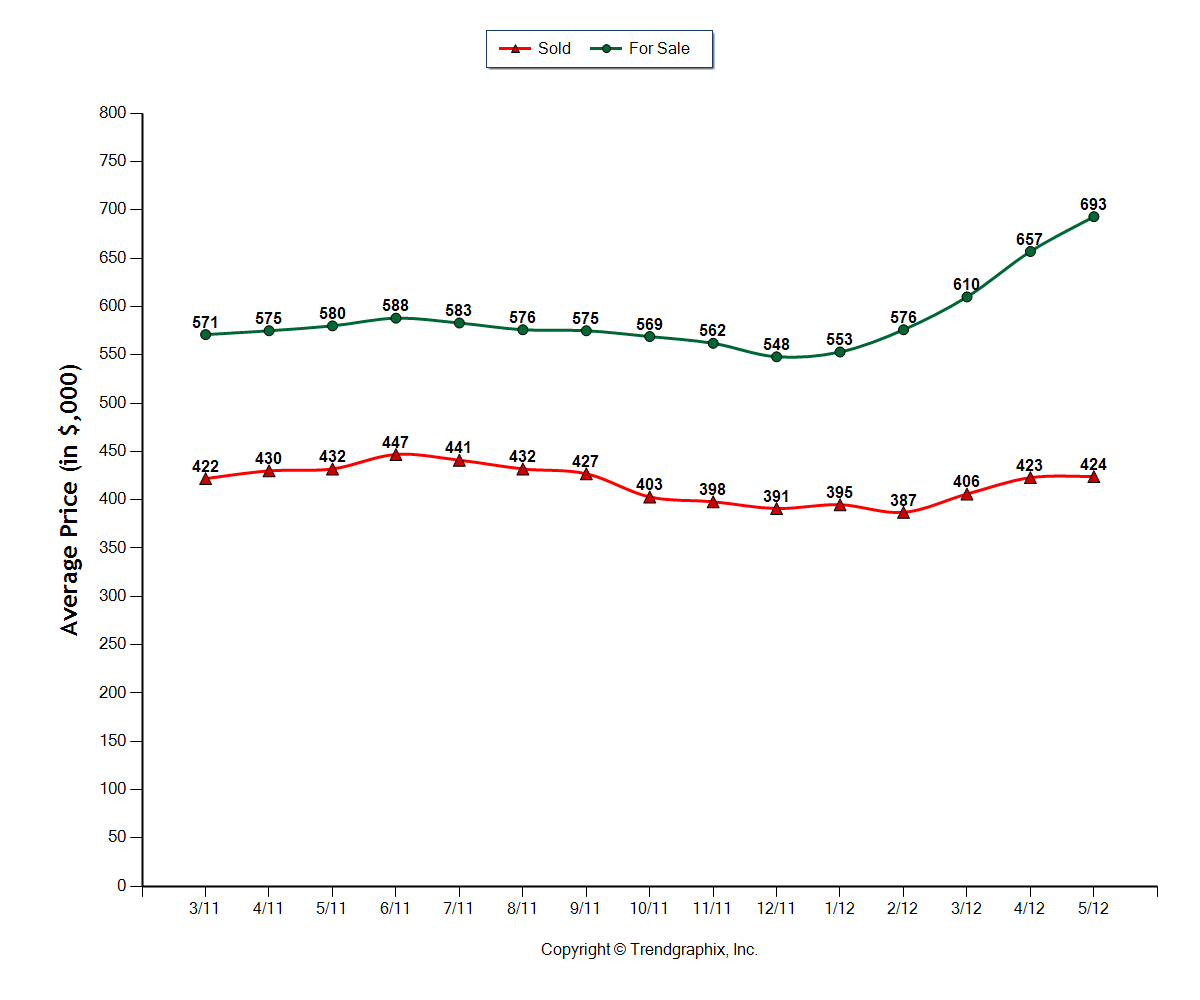

Is the housing market in a state of rational exuberance? Since the beginning of this year, activity, sentiment, and even prices, have taken a turn for the better. And it does seem that a solid case can be made that the housing market finally bottomed in late 2011 into the beginning of 2012. BUT, let’s not get too far ahead of ourselves and let’s not get too excited that prices are going to skyrocket and go up at a bubble inducing 10% per year again. However, if you look at the past 2 months in King County, “asking” prices are indeed skyrocketing up while sales prices have only increased a modest amount. Take a look at this chart for average For Sale and Sold prices in King County over the past 15 months:

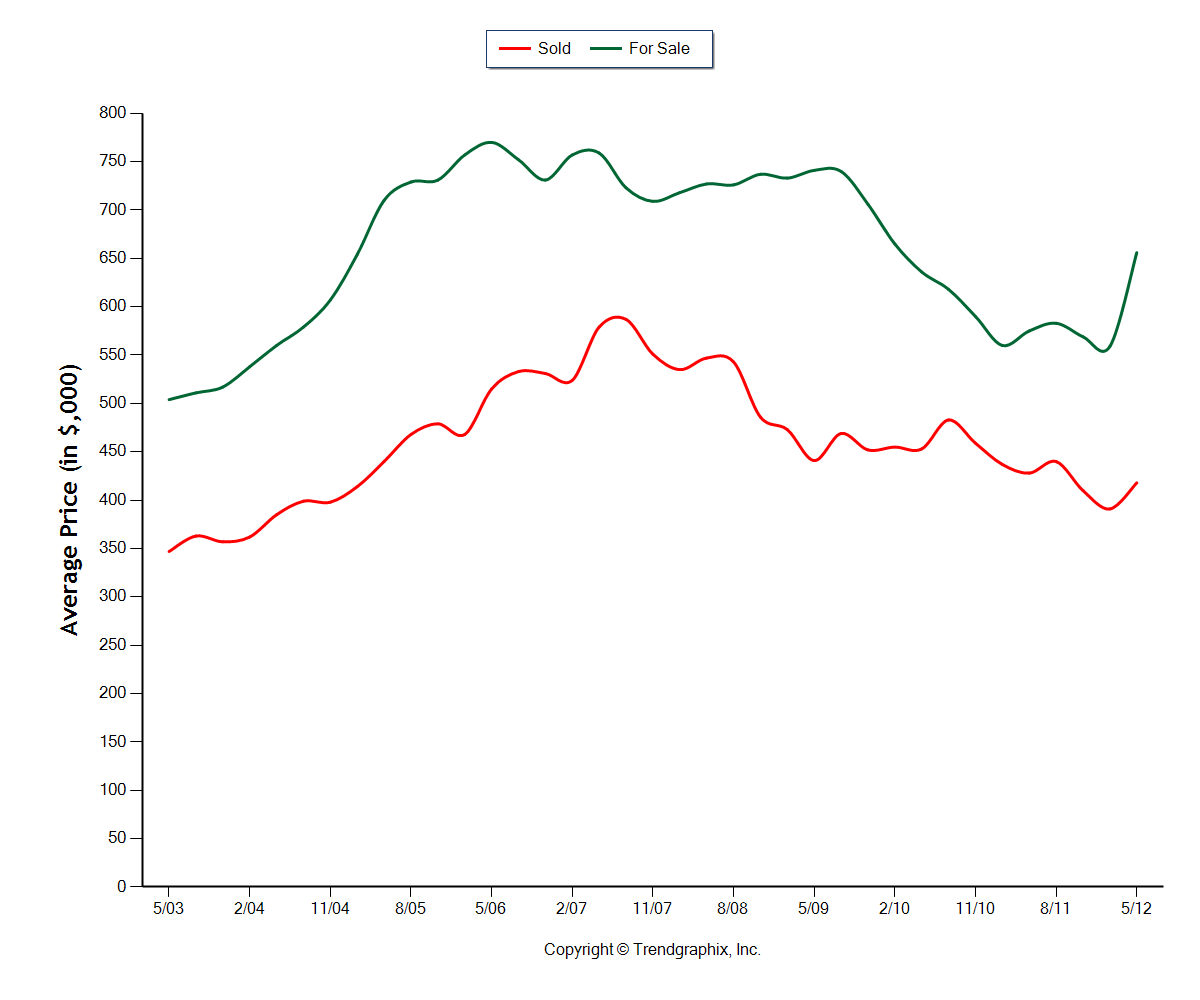

The average listed price (the green line) is currently $693,000. That is up 5.5% over last month alone and up 19.5% from May 2011! The red line is the average sold price and you can see that it has bumped up a bit since the beginning of the year, but it is only up $1,000 from April and is still actually down nearly 2% from last May. Here’s the same chart over the past 9 years:

To me, that recent blip in asking prices seems a bit irrationally exuberant to me, given what we’ve been through. However, if you dive a little more deeply into the numbers, inventory numbers are very low under $500k and staying low up to the $1million mark. So it looks like a good part of this widening of the gap between bid and ask is that the lower priced and more affordable homes are just selling quick and often. Higher priced homes are staying on the market longer and therefore the average price of “for sale” homes is simply a higher average price. If you’ve been looking to buy a home lately, you’ll know that inventory is very tight, to nonexistent, under $500k and when something does come on the market, especially in desirable neighborhoods, it’ll often be met with a bidding war.

It is essentially a sellers market in the Seattle area right now, especially in the lower price ranges. However, that does not mean you can ask 20% more for your home than you could have last year, it just means that you can lean toward the top end of your price range rather than have to settle at the bottom of the range to undercut your nearest competition like we’ve had to do the past few years. Right now, you may not have any competition in your neighborhood because it has all sold.

The moral of the story is that sellers can be rationally exuberant about selling right now, but just don’t be too irrationally exuberant when it comes to pricing your home. The same laws apply: if you price it fair, present it right, and your home is in top condition, you will sell quickly.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link