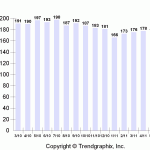

Stats are out for May and momentum is indeed continuing to increase. For King and Snohomish Counties combined, active listings are up a very modest 0.8% from April and down over 16% from last May 2010. Pending sales are up 13.6% from April and up a whopping 67.5% from last May. Of course we had the tax credit last year which stipulated that you needed to be under contract on a purchase by the end of April, so it is no surprise that pending sales fell off a cliff last May. Closed sales increased 2.4% from April and that is off over 11% from last year. Regardless, it’s nice to see a consistent uptrend in pending sales and closed sales this year. And given that new listings are only trickling in, that makes for a fairly balanced market since there is not a huge overhang of supply.

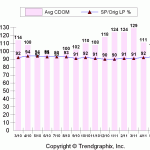

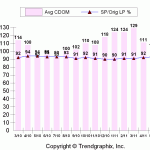

The average sales price in May was $388,000 and $175/sqft for King and Snohomish Counties combined. That is pretty flat compared to April, but down between 6% and 11% from last May. For your reference, average prices when looking at just King County were $436,000 and $191/sqft. And for just Snohomish County, the average price was $275,000 and $134/sqft. Looking at the combined data for the two counties gives a pretty good idea for average home values in the north King and south Snohomish county cities such as Lake Forest Park, Kenmore, Shoreline, Edmonds, and Bothell.

Days on market decreased to 104 from 111 in April, and on average homes are selling at 93% of the Original Listing Price. Of course, if you are priced right and presented well to begin with, your market time will be much shorter and your sales price will be much closer to the asking price.

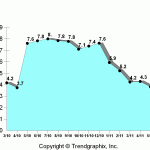

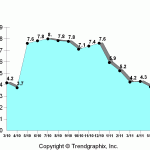

Finally, as I mentioned in the first paragraph, inventory is remaining relatively low and that is further confirmed when you look at a Months of Inventory chart. Looking at it based on Pending sales, we are now down to only 3.8 months of inventory which is as low as it was right before the tax credit ended last year and even as low as parts of 2006 and early 2007 when market activity was still doing quite well. Needless to say, I believe this is very positive for the market going forward and for the chances of a solid bottom being formed in home prices.

[slideshow]

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link