Like I’ve mentioned recently, it’s going to be tough to compare this year’s early statistics to last year because we had the tax credit in effect through last April. So, again it is not surprising to see that sales numbers this April are lighter than last year. Nevertheless, they’re holding up pretty well.

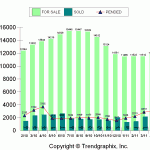

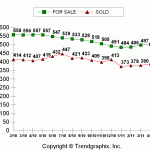

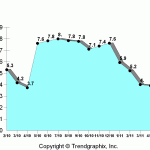

Sold and closed homes did decrease 7.2% from March and that is down 18% from last April. But Pending sales were up 5% from March, although that is still down over 18% from last April. Active listings are up only slightly from March, but down over 14% from last year. It’s really unusual not to see more new listings come on the market in the early spring, however our wetter than usual weather could be a contributing factor.

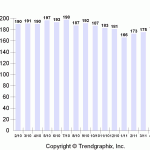

The average sales price for King and Snohomish Counties combined was $388,000 and $178/sqft. That is up 1.5-2% from March but down 5-6% from last April.

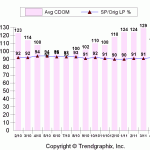

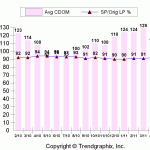

The average “Consecutive Days on Market” dropped from 129 to 111 and the “Sales Price as a Percentage of the Original Listing Price” ticked up 1% to 92%. The “Months of Inventory” based on Pending Sales dropped slightly to 3.9 months. That is almost as low as it was last year, again when we had the benefit of the tax credit. Obviously there’s no tax credit this year, but we do have fewer new listings with almost as many buyers so essentially we have a little more demand but with less supply.

My conclusion is that things are quite positive and while there’s been talk of a “double dip” in home prices- which there actually has, it is my humble opinion that this is a dip to buy. Low interest rates and a narrowing rent vs. own ratio is likely to keep demand strong for a while.

[slideshow]

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link