On a day that the stock market has plunged over 6%, let’s look at how the housing market has performed as of the end of July. Of course, selling or buying a house is not as easy as pushing a button, like it is to buy or sell a share of a stock. It moves much more slowly and therefore the trends can’t change and whipsaw you quite as quickly. That’s probably a good thing since it makes a home buyer or seller evaluate their decisions for the long haul, not just the next few months, days, or minutes!

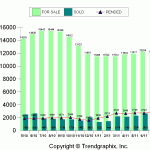

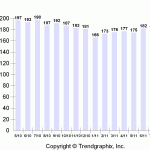

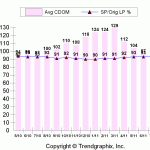

Anyway, on to the action in July… New inventory for King and Snohomish counties still remains subdued. Active listings are down 1.5% from June and they are down 22% from last August. Pending sales are up 6.6% from June and up a stellar 50% from last year. Closed sales did decrease 18% from June but they are still up 16% from July 2010.

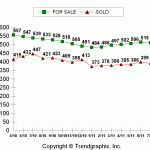

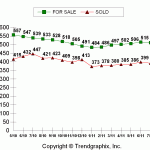

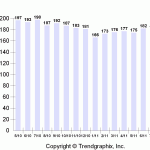

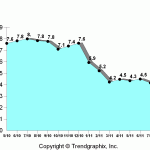

Sales prices have softened slightly from June to an average of $392,000 and $180/sqft. That is 8-12% lower than last July. Average days on market came down from 97 days in June to 92 days in July, which is about the same as last year. And again the inventory is staying low at about 4.1 months based on Pending Sales.

While stock market volatility is never a good thing, at least it should help to keep mortgage interest rates historically low for a while longer. But, how much consumer confidence is affected and if/how the turmoil carries over to the housing market, remains to be seen. Two things are for sure, money is cheap to borrow right now, and real estate as an asset seems a whole lot less volatile and likely a safer investment in the long run.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link