Stats are out for January and there are some interesting things to look at. After the “calm” of the holiday season, we are off to a brisk start to the new year. Open houses were very busy in January and that has seemed to translate into contracts written.

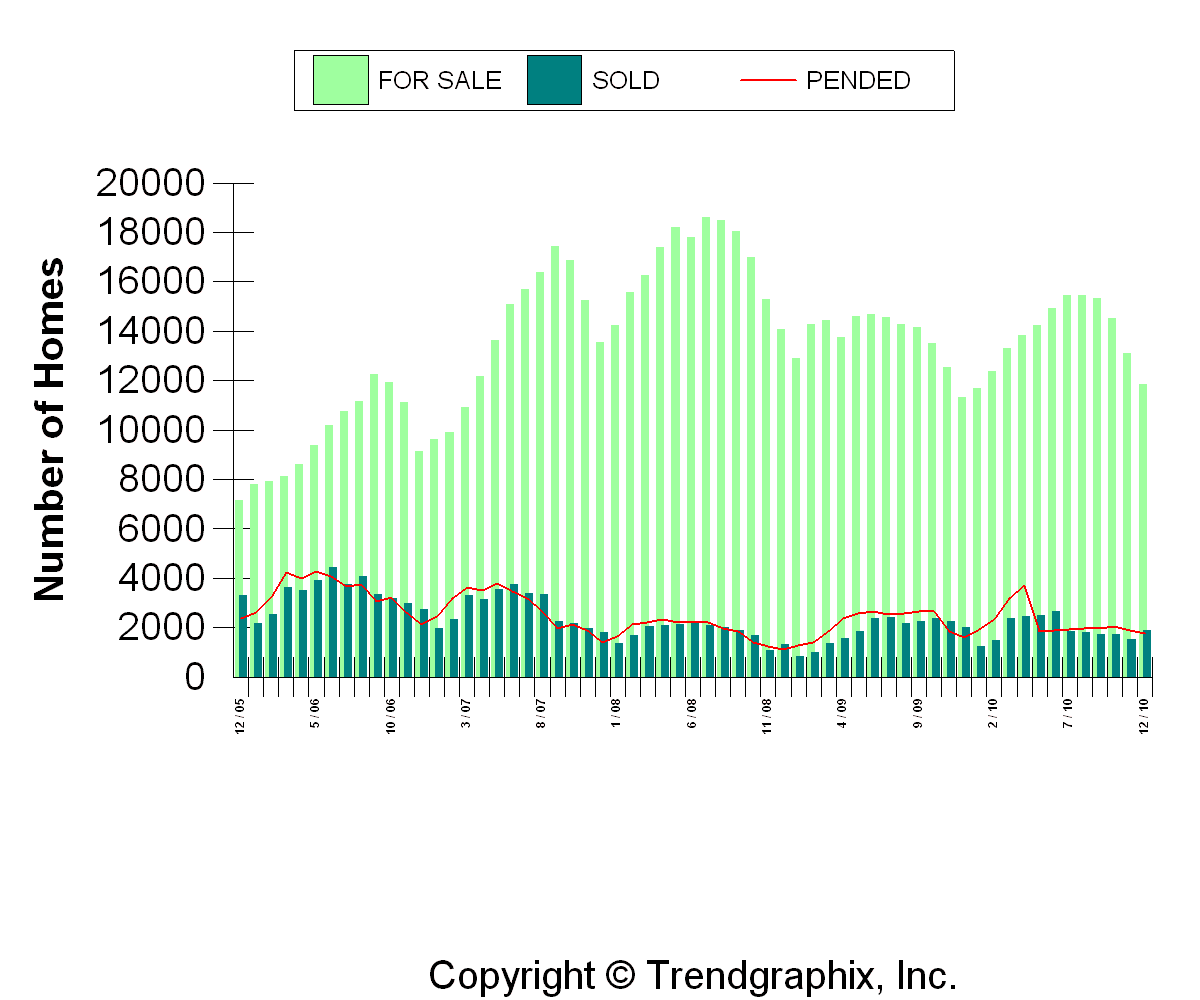

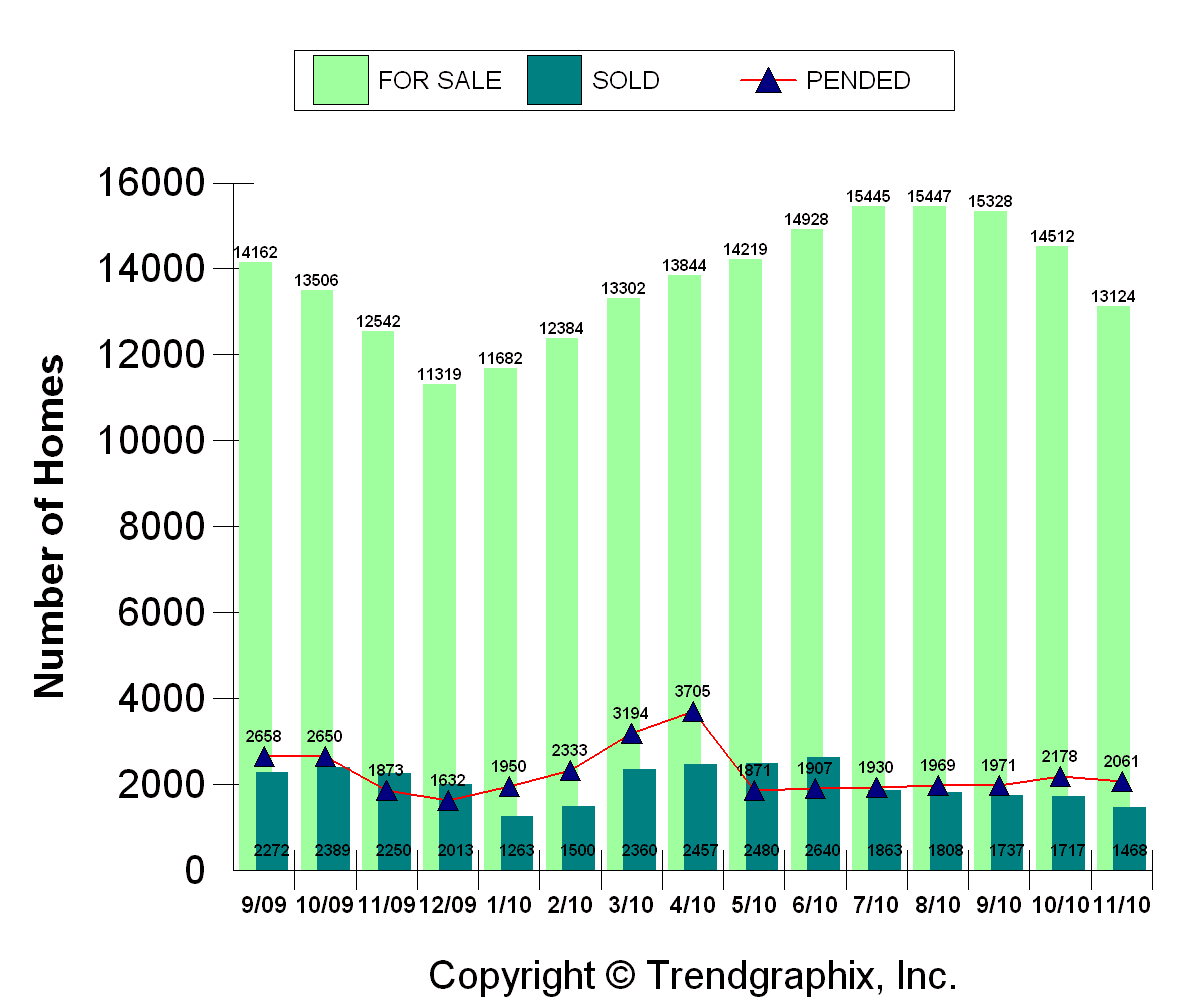

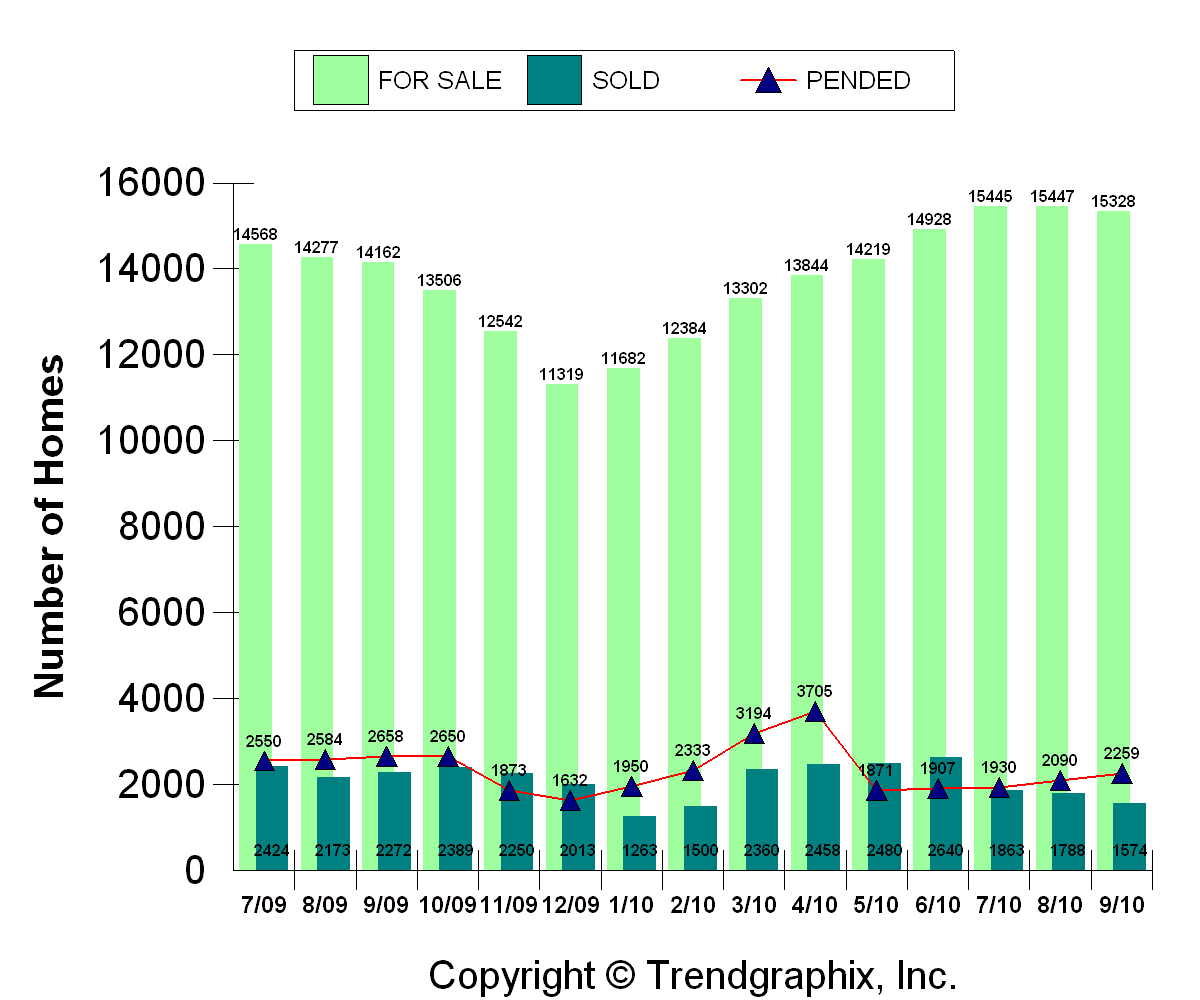

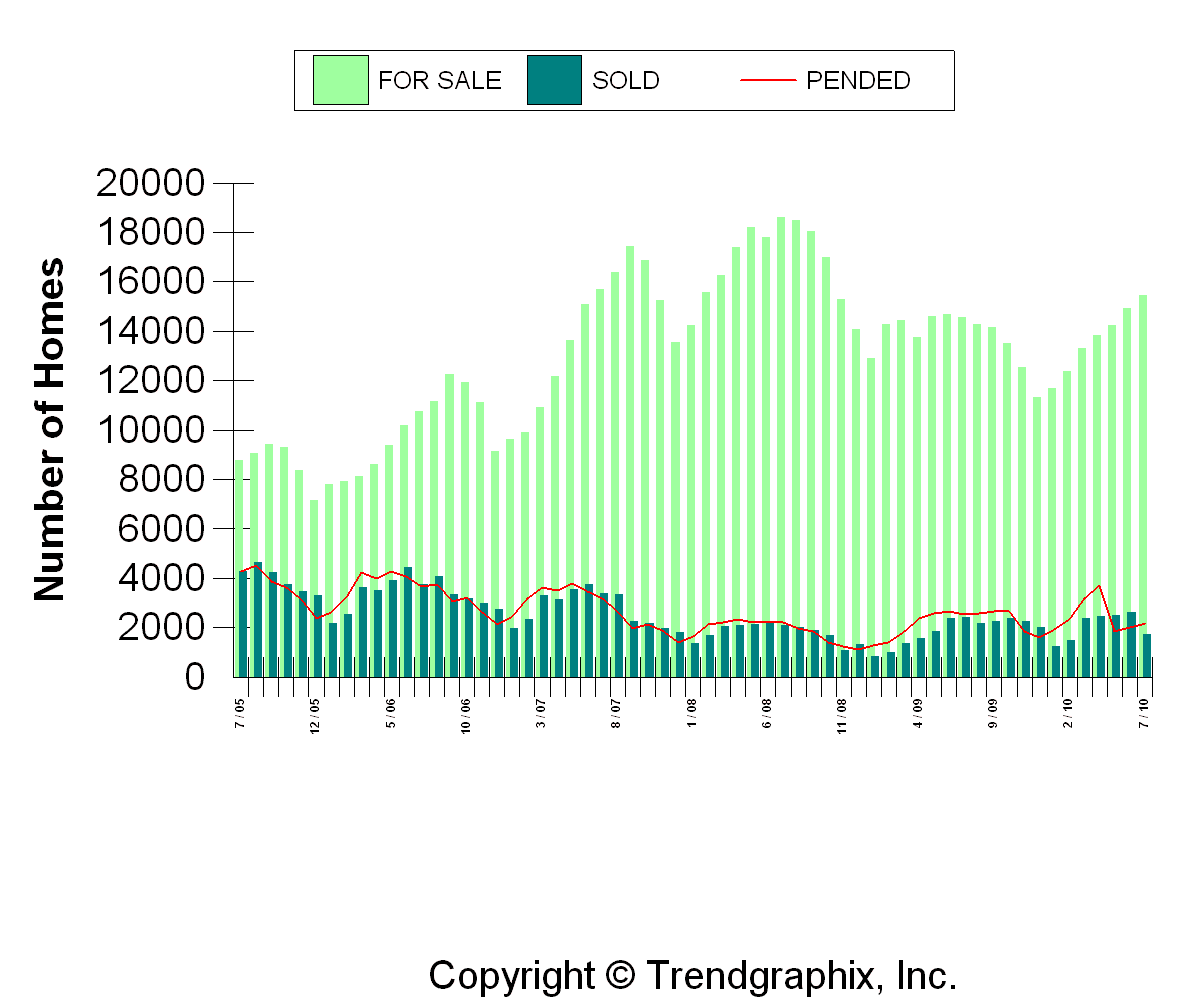

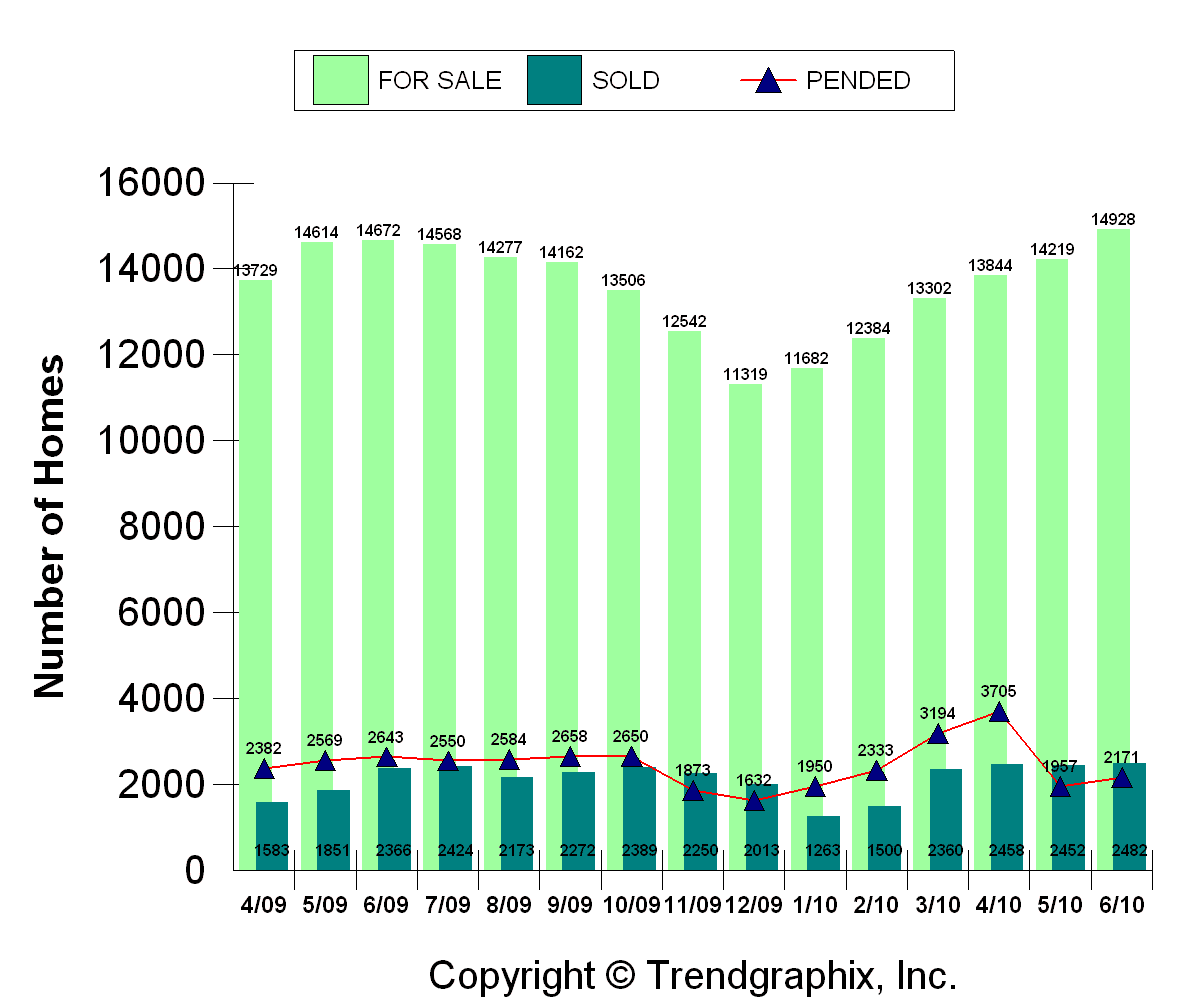

Closed sales decreased in January, which is fairly normal, but pending sales shot up almost 34% from December and over 12% from last January. And active listings decreased slightly from December rather than increasing like they did last January. Remember last year, we had the tax credit that was extended until the end of April so it will be nice this year to NOT have that arbitrary “deadline” for people to make moves. The market should be a little more steady as we roll through the spring and summer seasons.

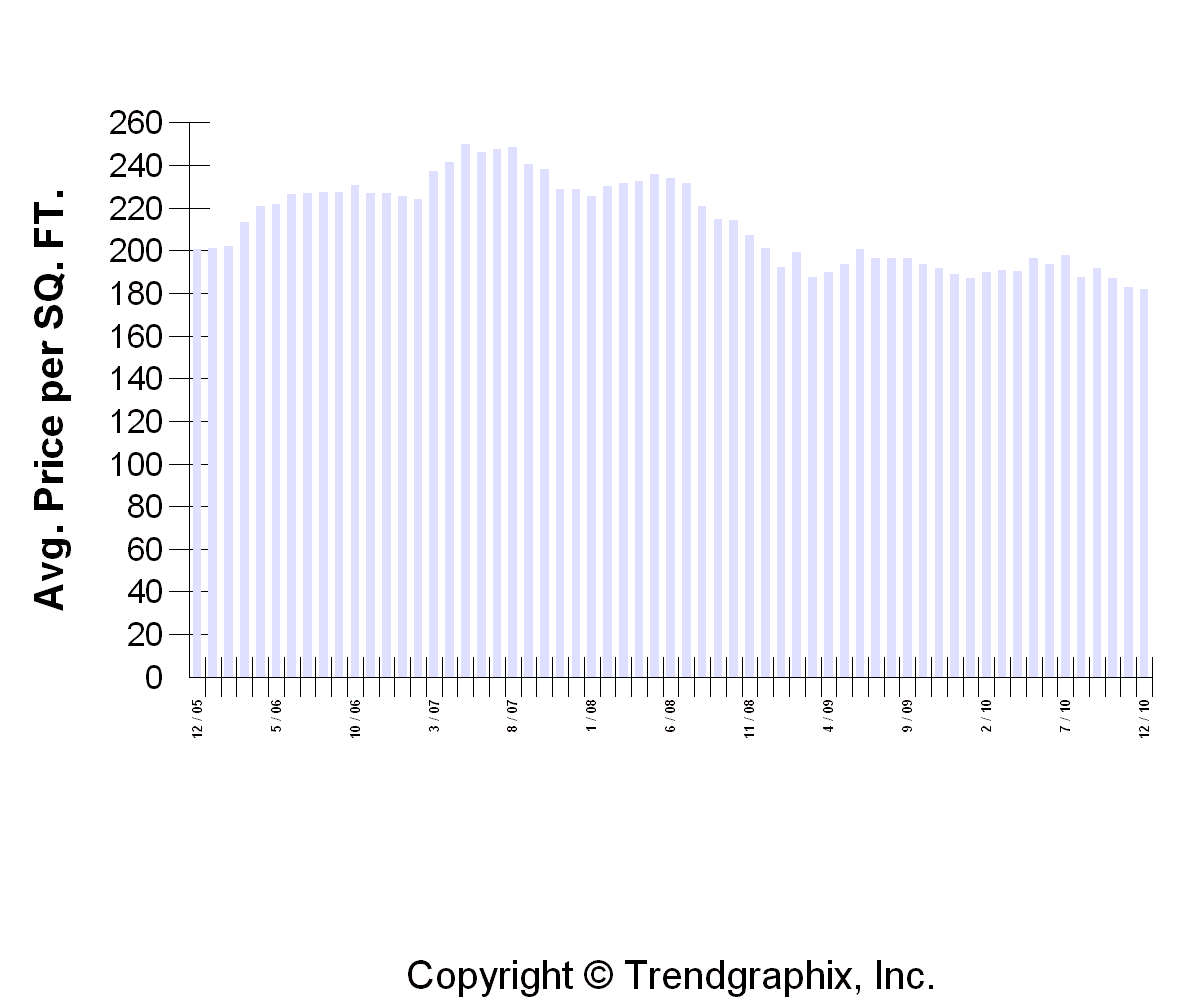

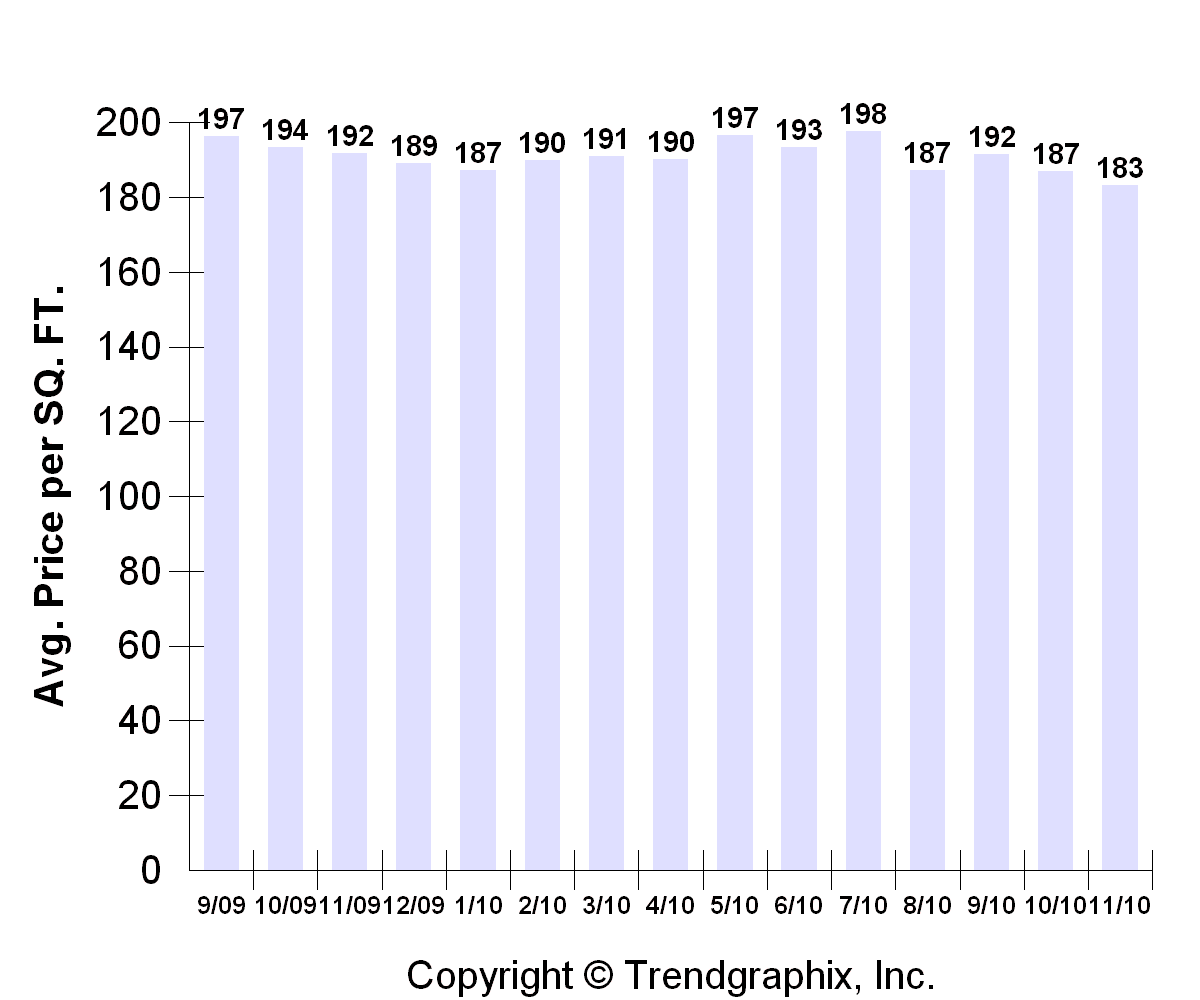

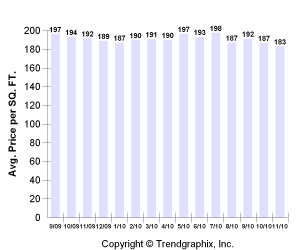

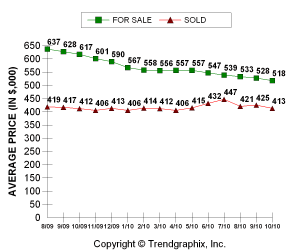

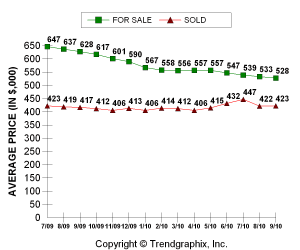

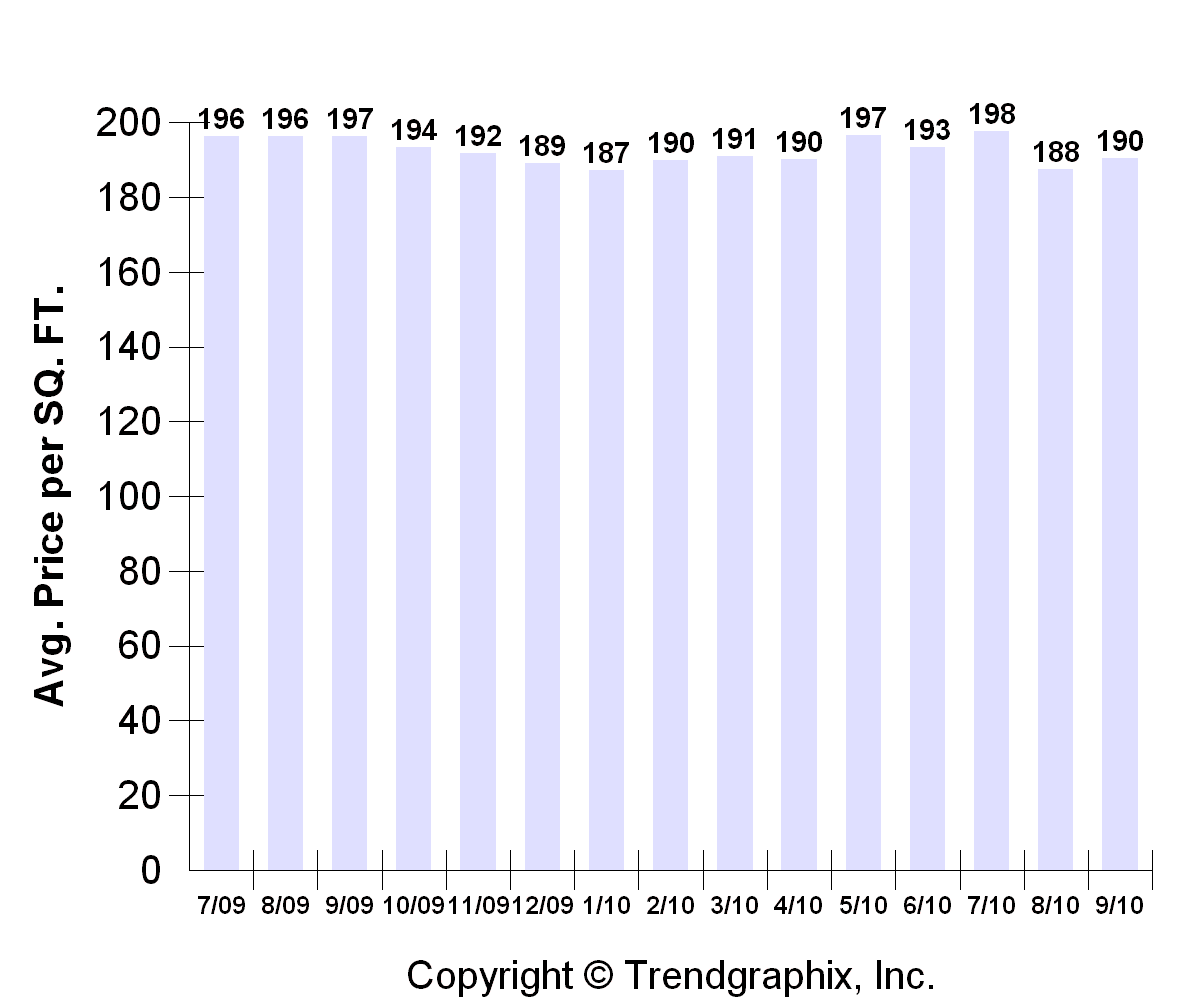

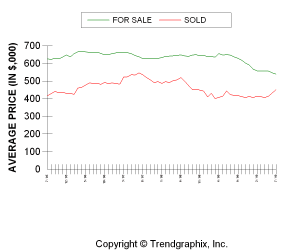

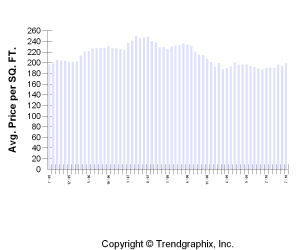

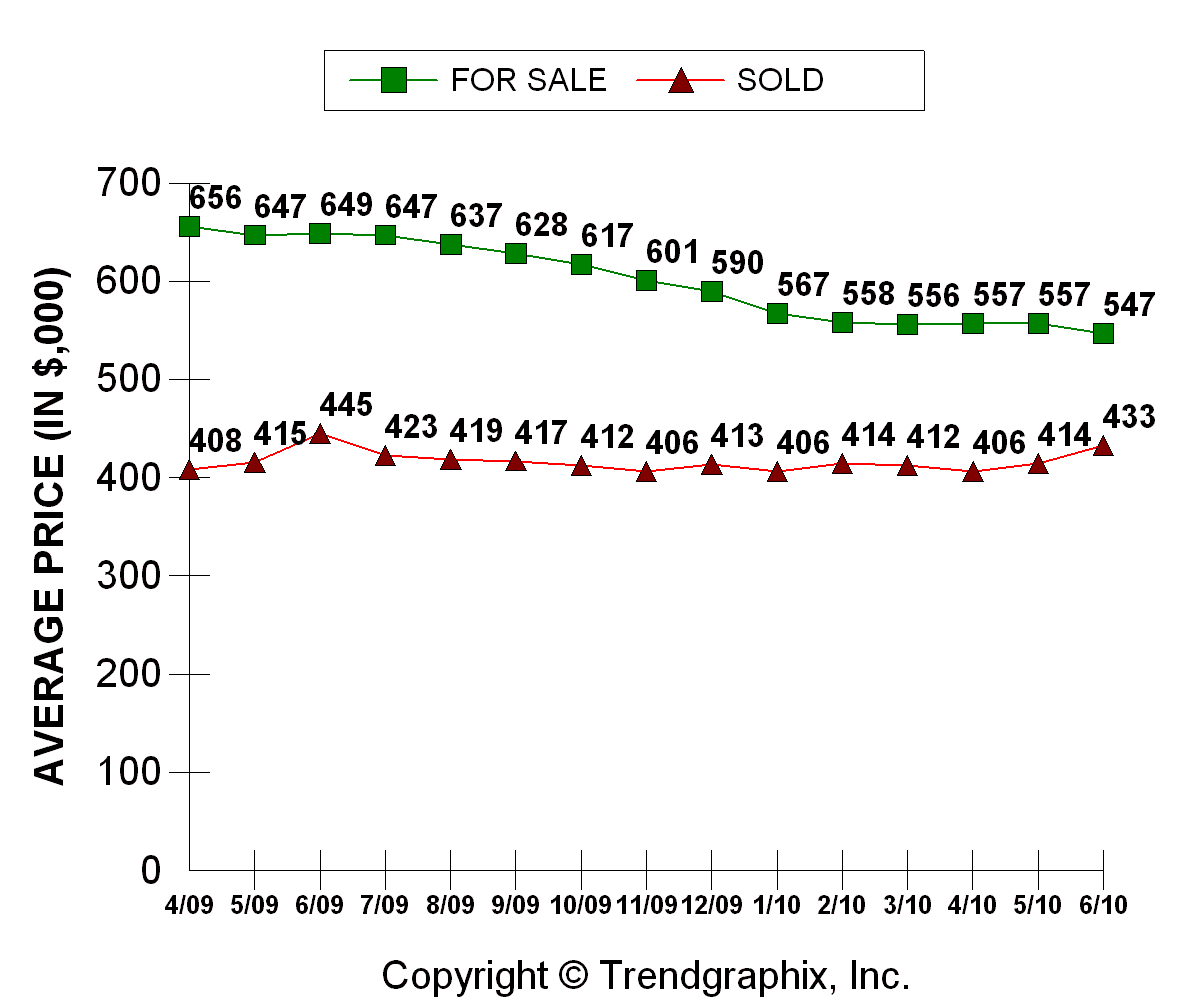

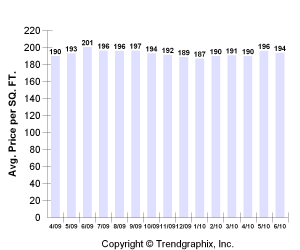

Now as far as prices are concerned, it is a little surprising to see that they dipped to new lows in January… For King and Snohomish Counties combined, the average sales price was $375,000 and $167/sqft versus $412,000 and $181/sqft in December. Now, it’s possible some extra discounting took place to get homes sold at the end of the year, but time will tell if it’s the beginning of a new trend lower or just a headfake. I do see a lot of sellers working hard to make deals with buyers, but now that a lot of the existing inventory of well priced homes is getting sold, there might be a little more competition between eager buyers going forward. That’s pure speculation on my part but rising interest rates and fewer homes to choose from could at least give a little more of a bid under prices as we get into spring.

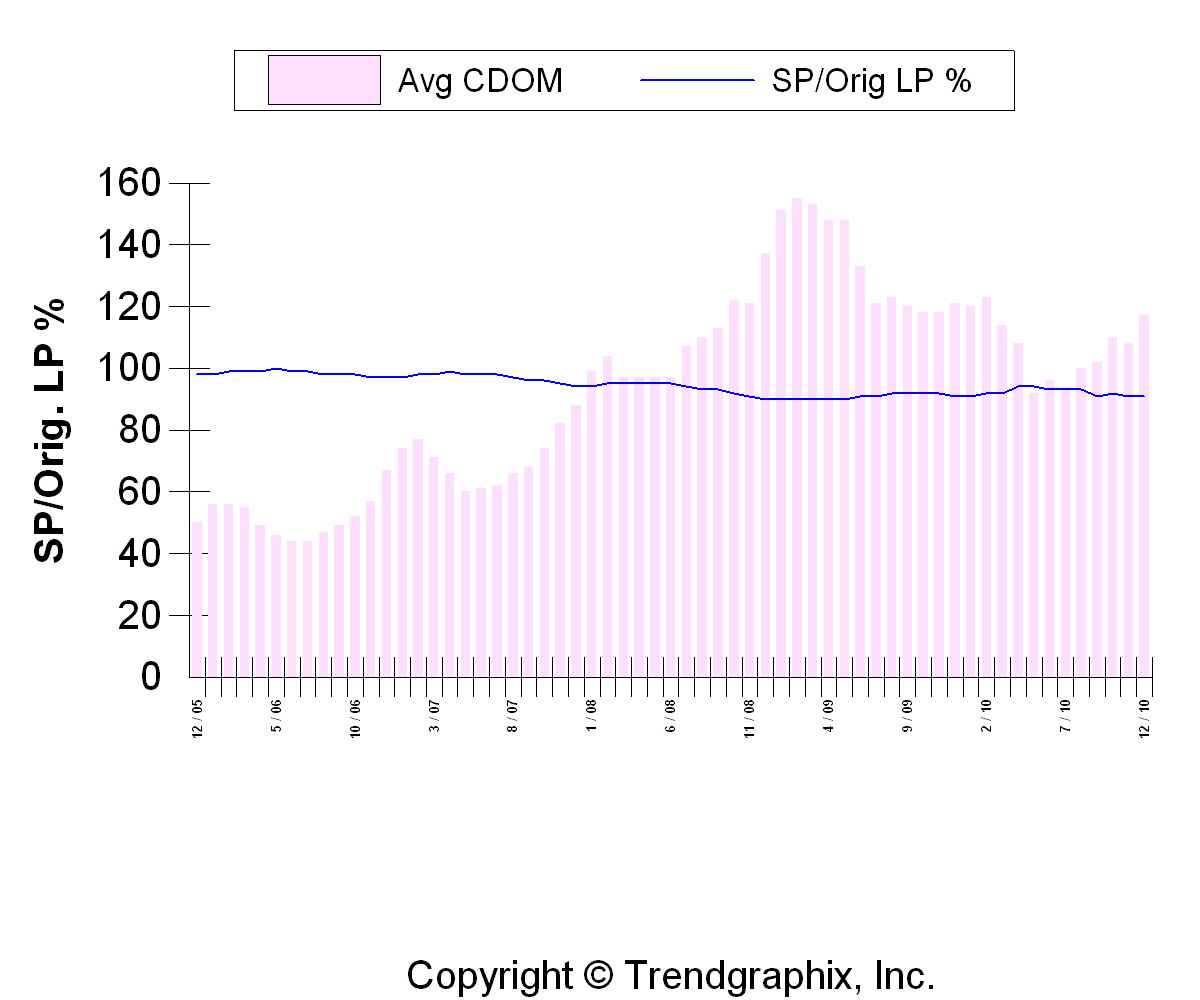

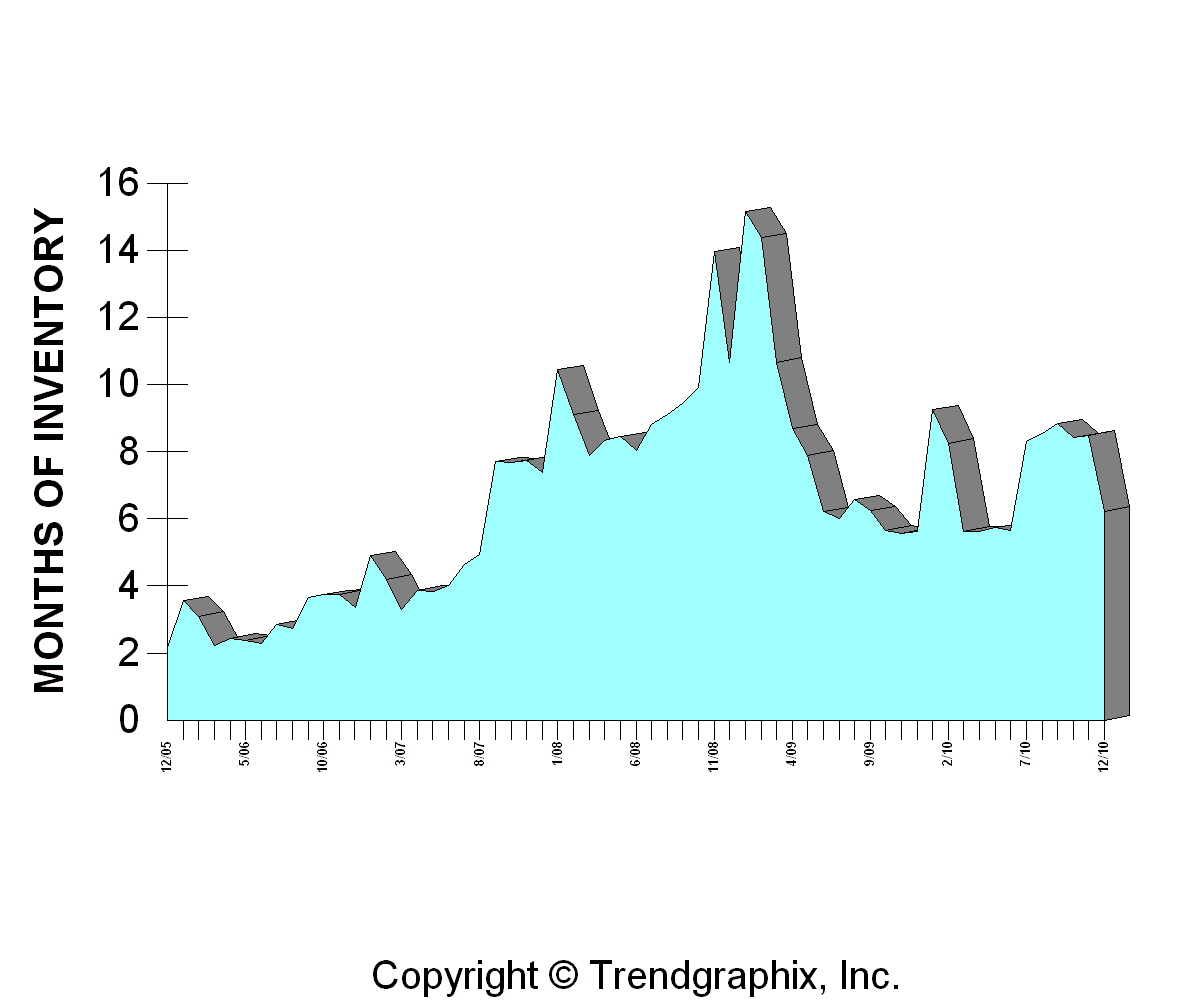

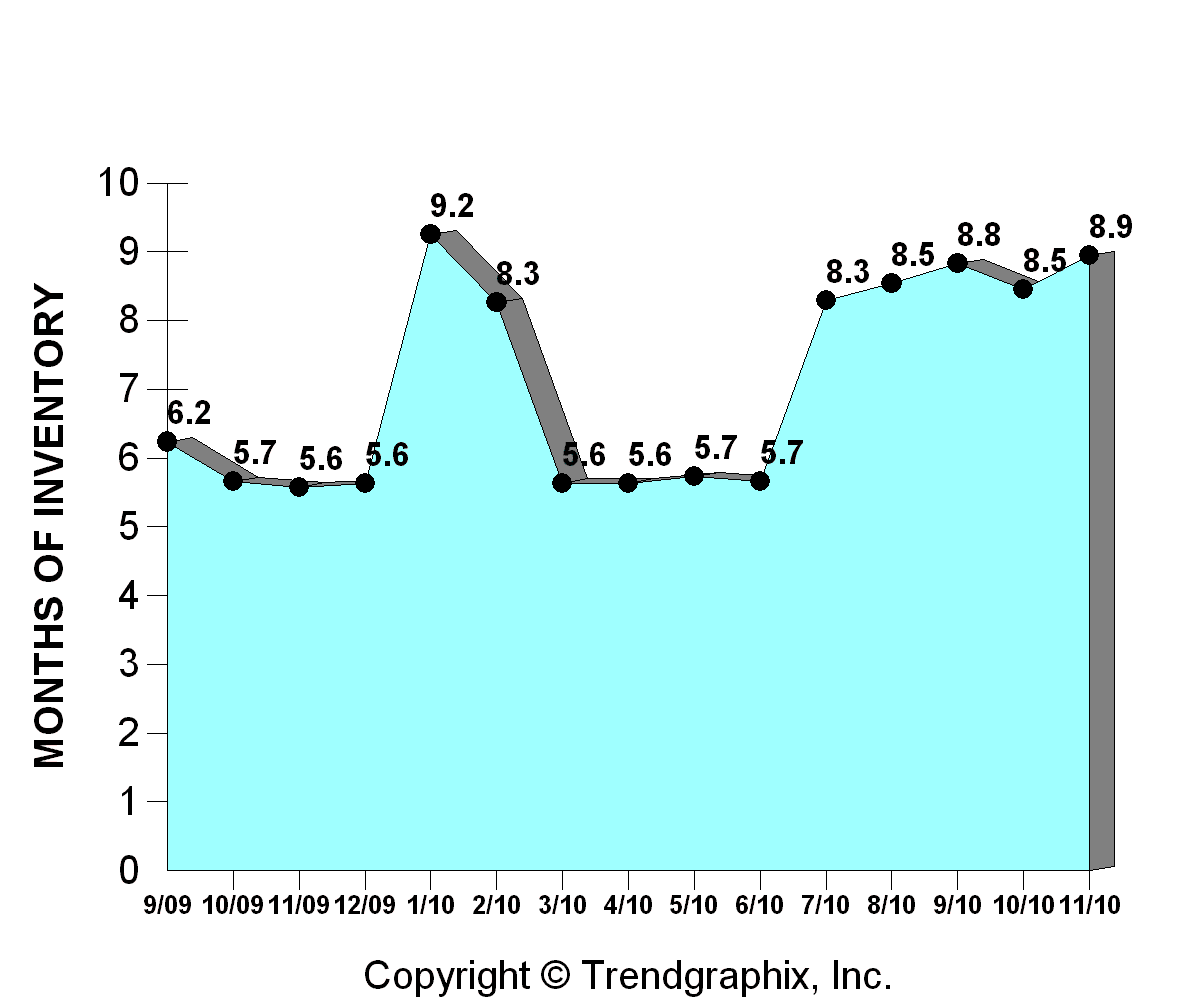

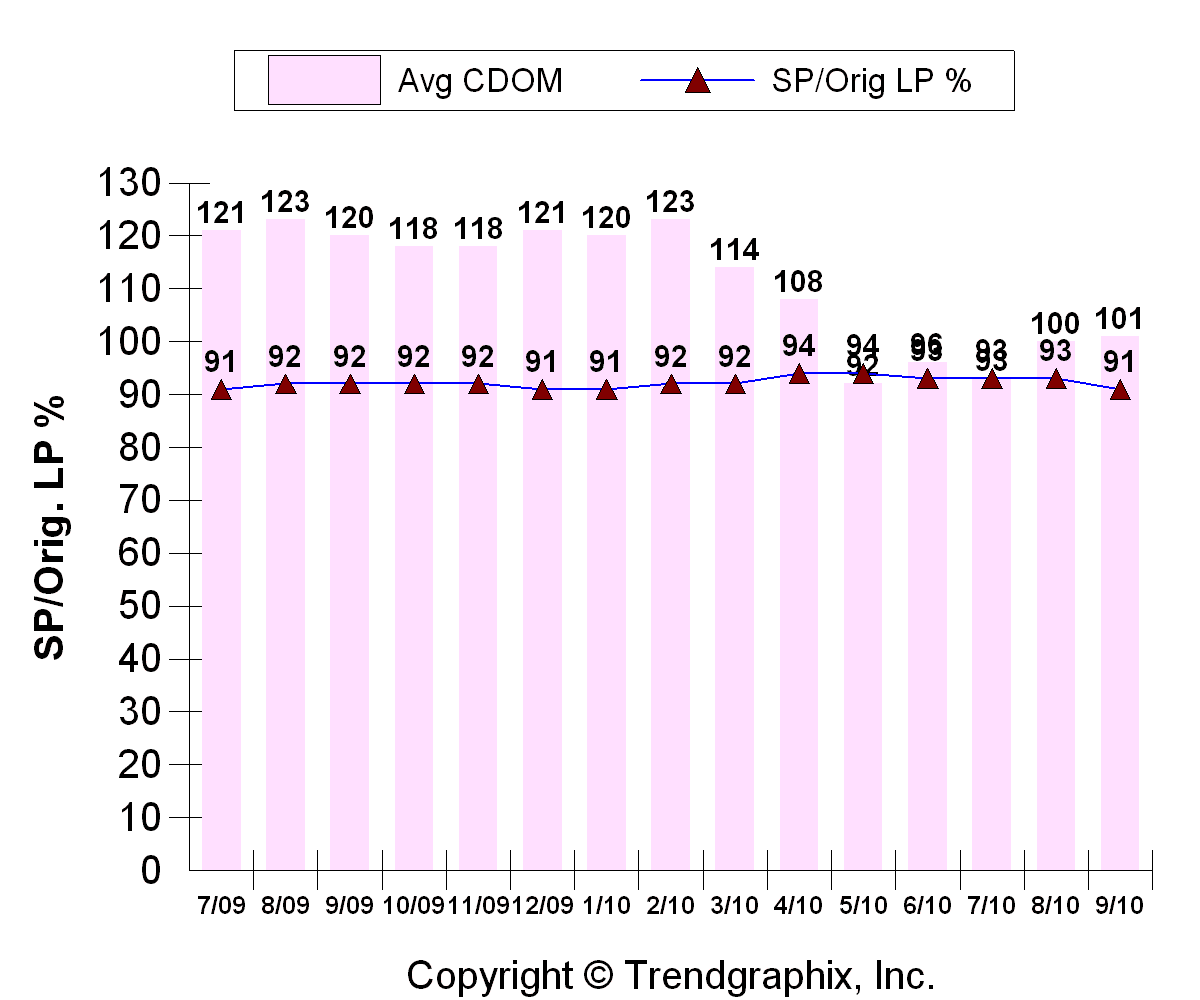

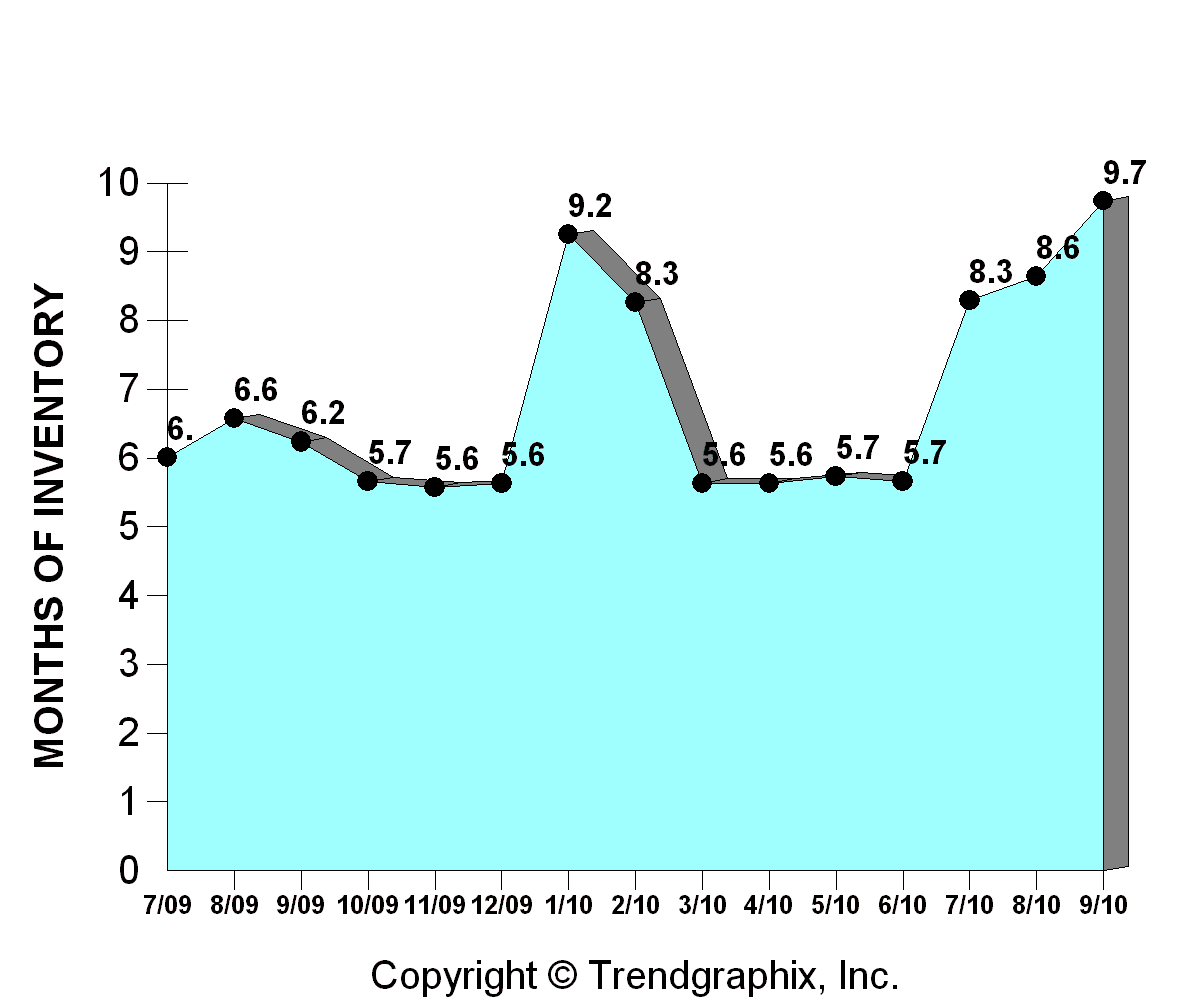

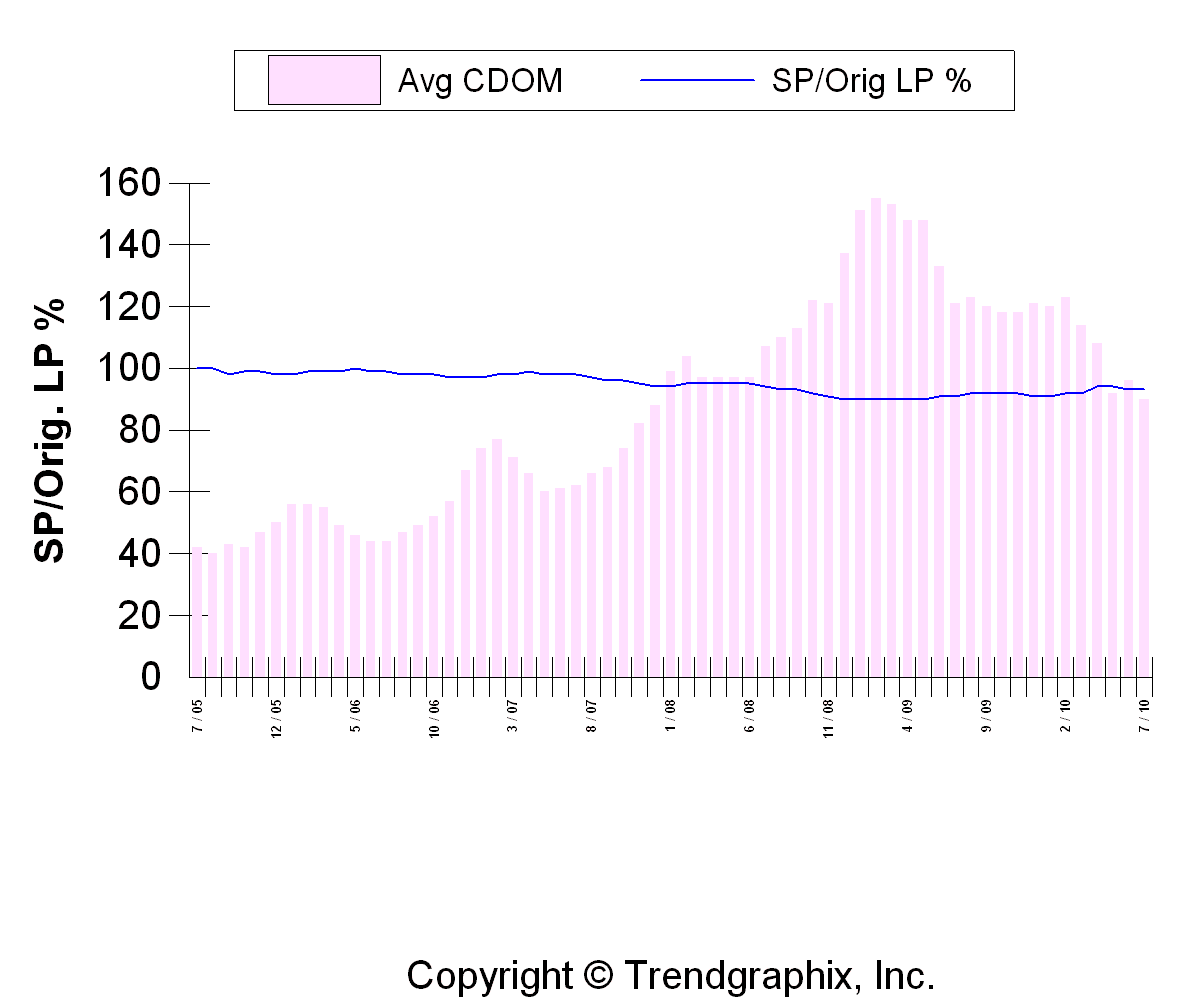

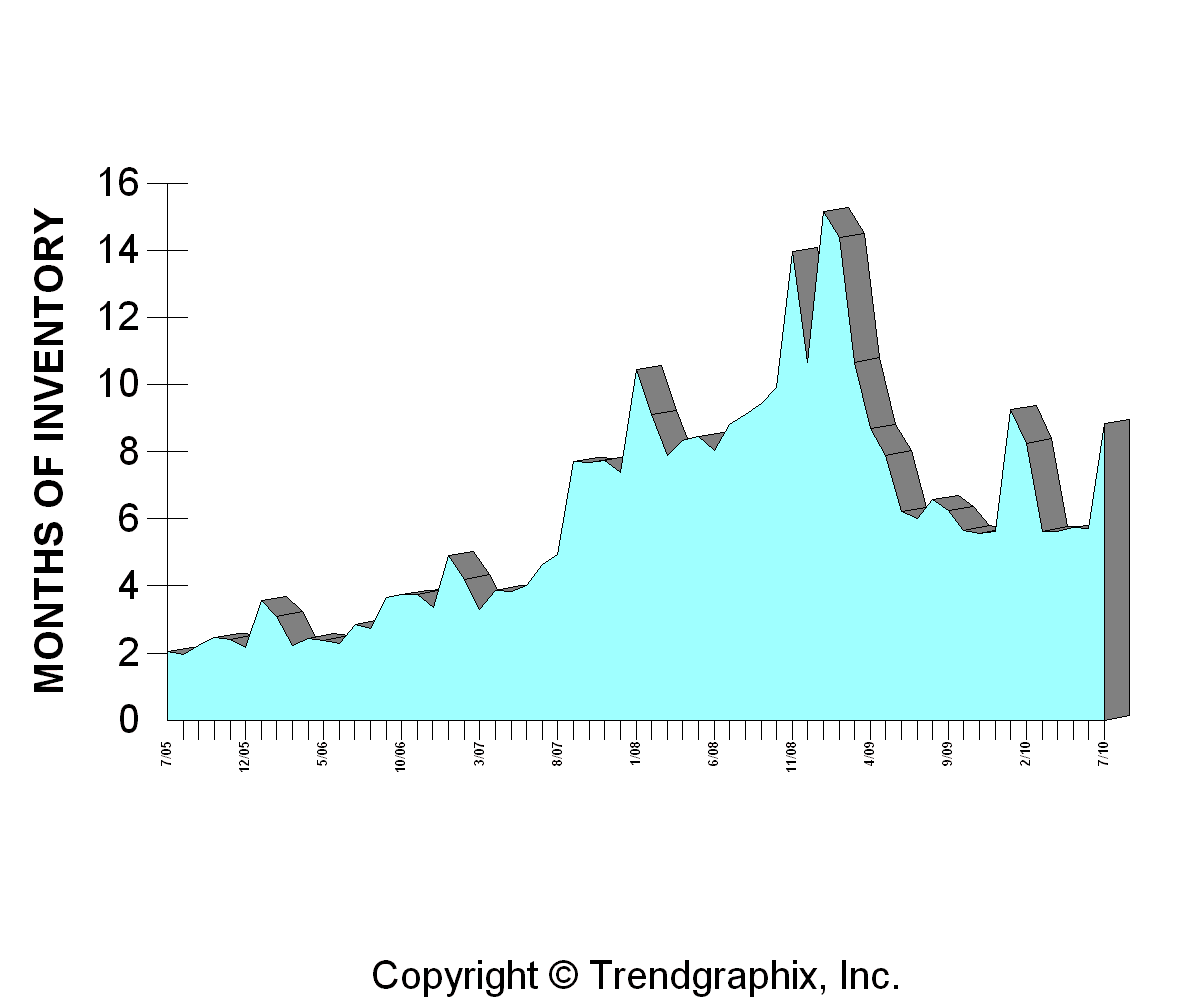

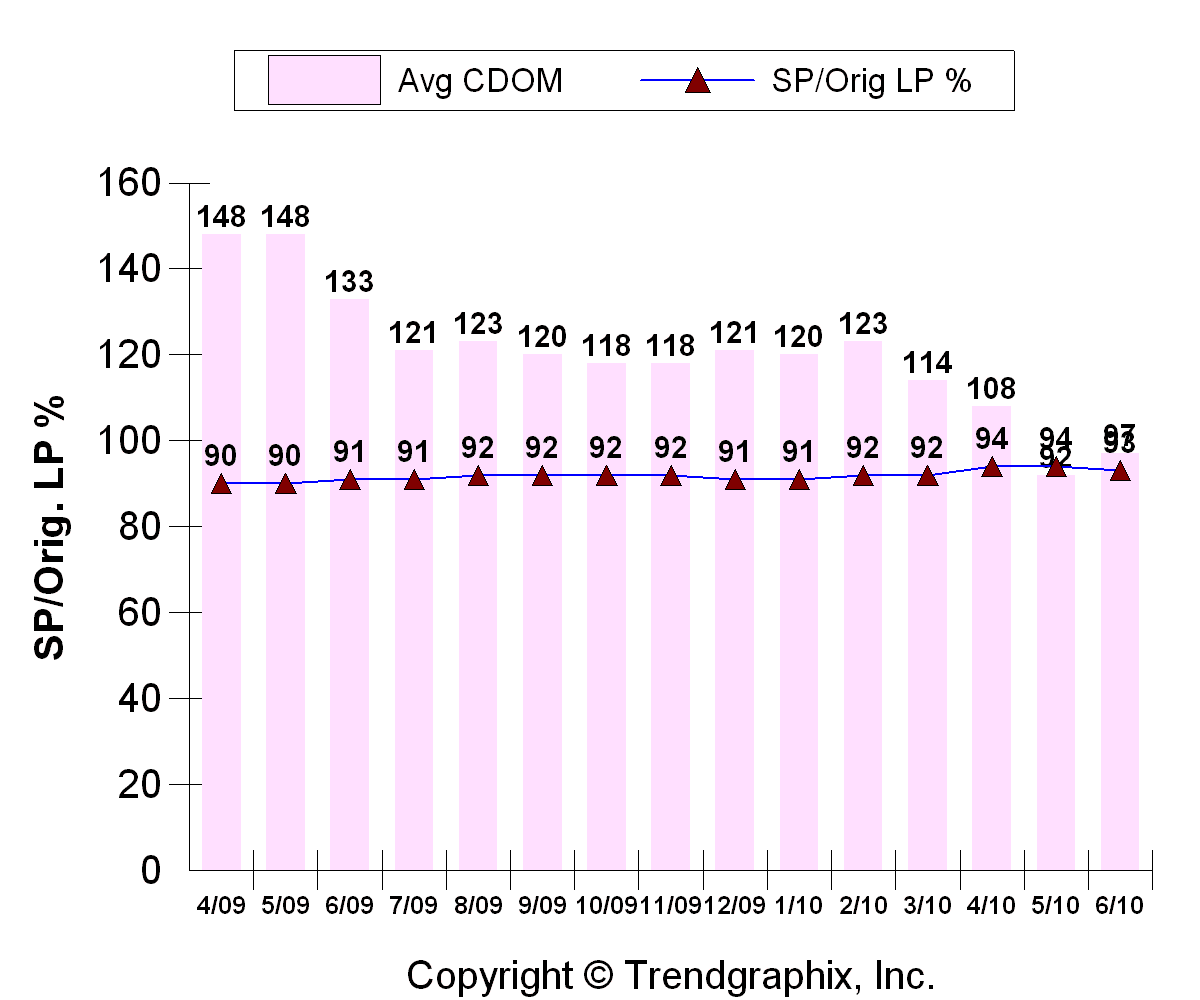

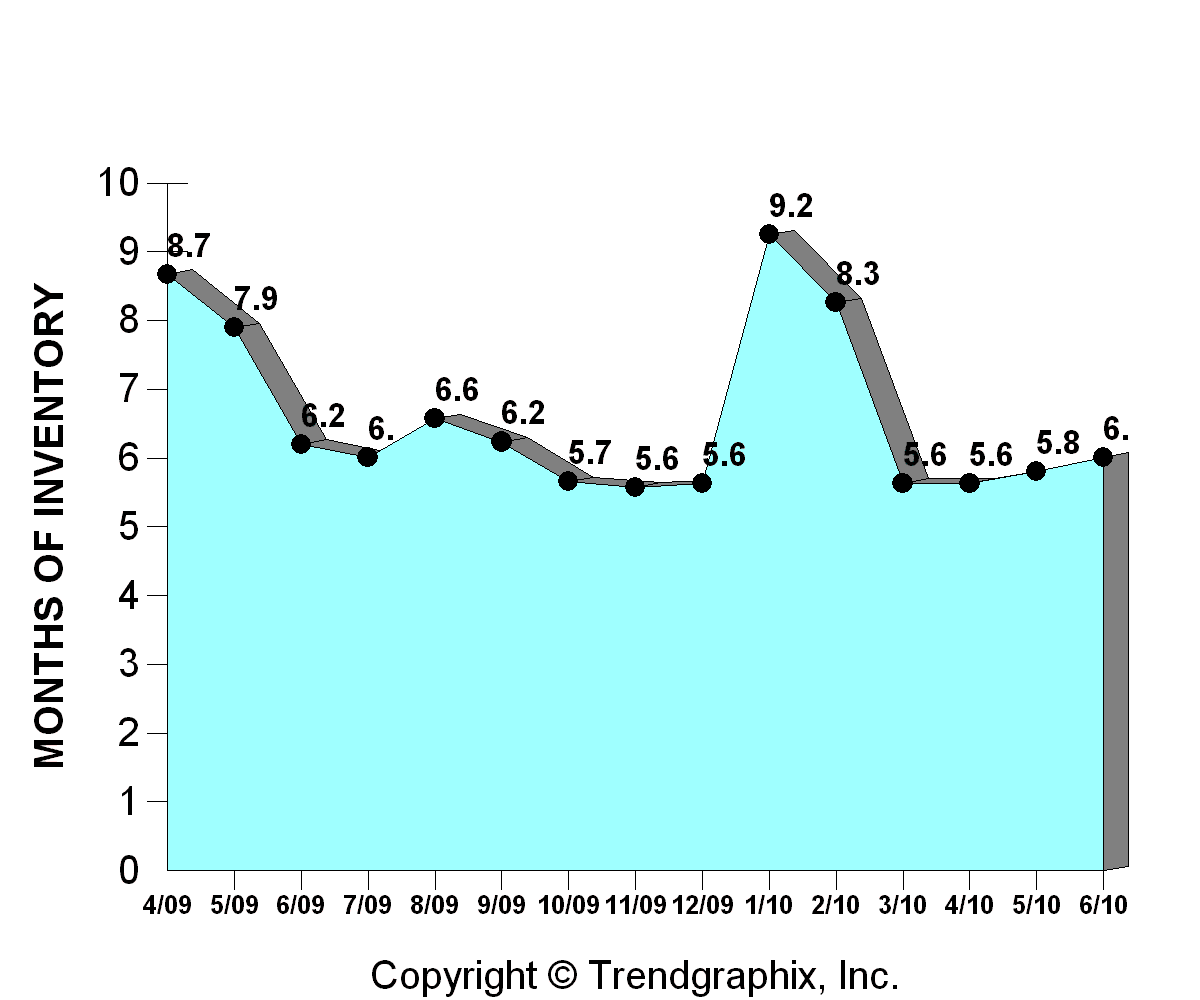

Consecutive days on market bumped up to 125 days while the “Selling Price as a Percentage of Original Lising Price” dipped slightly to 90%. The “Months of Inventory” based on CLOSED sales rose sharply to 9.3 months. But if you look at the same thing based on PENDING sales, inventory decreased sharply to only 5.2 months, which is lower than where it was last January when we had the benefit of the tax credit.

So it’s important to step back and look at the information in a broader context and realize that even the data for closed sales in January is backward looking- I like to look at pending sales to give a better idea of where things are going. And at this point, I’m very optimistic about the market this year and I am looking forward to a busy spring!

[slideshow]

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link